Trust This.

By Joseph E. Seagle, Esq.

👋 Happy Friday! Tuesday was Constitution Day, marking the 248th anniversary of the adoption of the U.S. Constitution. The week has been declared as “Constitution Week.” Every lawyer swears an oath to support the Constitution of the United States. Soldiers pledge to support and defend the Constitution against all enemies, foreign and domestic. Elected officials pledge an oath to “preserve, protect, and defend the Constitution of the United States of America.” This document, as amended by “we the people,” and interpreted by the Judicial Branch over almost two and a half centuries, is the bedrock of our democracy and worth another read.

❗Situation Awareness: The sales tax on commercial rents has been repealed and should not be charged or paid on such rents, starting October 1, 2025.

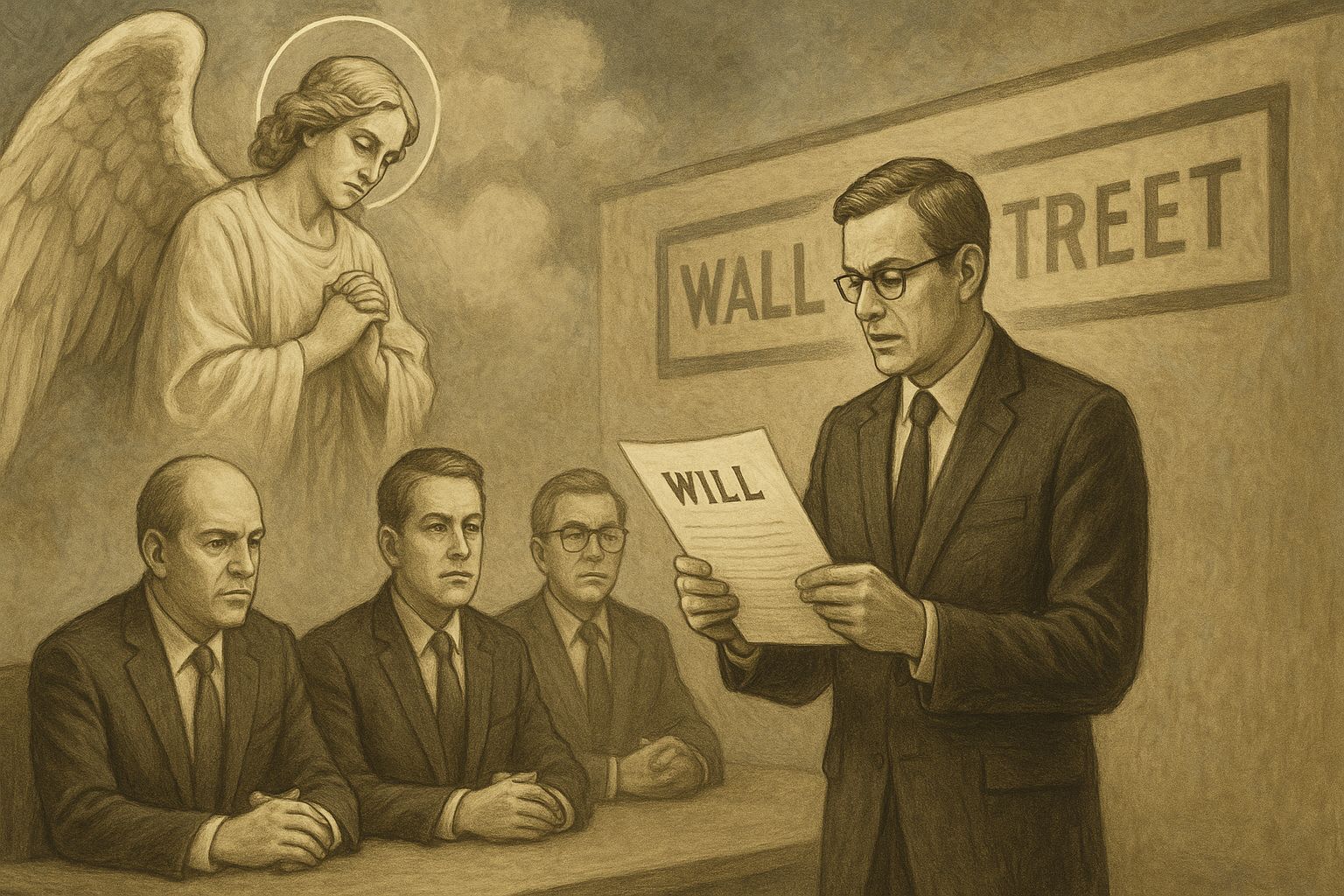

1 big thing: Armani’s will vs. Siegel and Buffet Trusts

Angel investors?

Florida entrepreneurs and professionals can draw sharp lessons from three industry titans: Giorgio Armani, David Siegel, and Jimmy Buffett. Armani’s meticulously drafted will appears poised to preserve his global fashion house, while Siegel’s and Buffett’s estates are tied up in disputes that risk diluting their brands and fortunes.

Vision: Armani plans beyond the grave

Armani’s will is more than asset distribution—it’s a business roadmap. He transferred full ownership of his fashion empire to the Giorgio Armani Foundation, ensuring the brand’s values remain protected. He also ordered a staged sale of up to 54.9% of the company, specifying preferred buyers like LVMH or L’Oréal. By retaining a minimum foundation stake, Armani built in guardrails against hostile takeovers, while still allowing growth through IPOs or strategic partners.

Traction: Siegel and Buffett show what happens without clarity

David Siegel, the Florida timeshare king, left behind trusts that are now contested. Alleged improper amendments, potential conflicts of interest, and family challenges threaten to drag Westgate Resorts into prolonged litigation.

Jimmy Buffett’s $275 million estate, meanwhile, is locked in a legal feud between his widow and the co-trustee accountant over fees and control of assets like Margaritaville. Both cases highlight how even sophisticated trusts can backfire if roles, dispute‑resolution, and oversight aren’t crystal clear.

People & Process: Governance matters most: Armani separated voting rights, non‑voting shares, and foundation oversight to manage expectations and prevent infighting. In contrast, Siegel’s dual‑role trustee and Buffett’s co‑trustees with competing agendas created fertile ground for conflict. The lesson for Florida practice owners and entrepreneurs: governance structures, not just wills and trusts, determine whether businesses endure or erode after a founder’s death.

The takeaway: For Florida professionals—whether running a medical practice, law firm, or real estate business—the message is clear: estate planning must combine asset transfer with operational strategy. A foundation, clear voting structures, staged exits, and strong trustee guardrails can protect decades of work. Without them, heirs may inherit lawsuits instead of legacies.

What’s next: Expect Armani’s model to become a case study in business succession. In Florida, where many entrepreneurs build multi‑generational practices and family businesses, the challenge is to adapt those lessons locally—ensuring continuity, clarity, and control, long after the founder is gone.

2. Fed rate cut won’t guarantee mortgage relief

Florida’s small business owners, real estate investors, and professional practices eyeing mortgage relief after the Federal Reserve’s September rate cut may want to temper expectations. This week, the Fed trimmed its benchmark rate by a quarter-point—the first cut since 2024—and signaled two more could follow this year. But history suggests mortgage rates won’t necessarily keep falling.

Vision: Rates may drift, not dive

Mortgage rates had already eased ahead of the Fed’s move, with the average 30-year fixed mortgage at 6.35%—its lowest in nearly a year. Analysts expect them to hover in the 6.3%–6.4% range through 2025, well above pandemic-era lows and still a drag on affordability. For Florida entrepreneurs, that means financing for office space, medical practices, or investment properties will likely remain expensive relative to historic norms.

Traction: Strategy in a “stuck” market

Like last year, when rates briefly dipped before climbing past 7%, Florida professionals shouldn’t bank on a steady downward path. Inflation pressure and bond market swings could reverse recent gains. Investors should weigh refinancing only if they can cut at least a full percentage point off existing loans—enough to offset fees . Business owners considering new space may find that locking in sooner, rather than waiting for dramatic declines, avoids getting priced out.

People, Process, Data: Affordability logjam persists

Florida’s housing market has been sluggish since rates spiked in 2022 causing a “flash crash.” Even with this summer’s dip, home prices are still up 50% nationally since 2020. Lower rates could draw more buyers into competition, but they won’t fix the affordability gap without slower price growth—or outright declines. For practices recruiting top talent, the cost of housing remains a barrier for young professionals weighing relocation.

The takeaway: For Florida entrepreneurs and practice owners, the Fed’s cut is a modest relief, not a market reset. Mortgage rates are likely to remain in the mid-6% range through year’s end, keeping real estate costs elevated and capital planning tight. Strategic moves—like early refinancing, flexible lease structures, and careful capital deployment—matter more than betting on a rate plunge.

What’s next: Watch September’s inflation data and the Fed’s next meetings. If inflation stays sticky, mortgage rates could rebound, pressuring affordability further. Florida’s business community should plan for gradual, uneven changes—an environment where a smart financing strategy is the edge.

In this weeks’ Tips & Tactics edition of the Trust This podcast, we dig deep on 1031 exchanges, discussing how to simplify your portfolio while deferring taxes. Michael Velasco is a Certified Exchange Specialist, one of only 100 in the country. Coupling his extensive experience with my stories of 1031s in the trenches, it’s our hope that listeners will gain a deep understanding of the pros and pitfalls of 1031 exchanges - whether forward, reverse, or improvement - along with Delaware Statutory Trusts (DSTs) and Tenant in Common (TIC) structures as replacement properties.

3. Joint Ventures: the “situationship” of business entities

Business owners often need to team up for opportunities without tying the knot forever. That’s where a joint venture (JV) comes in — the “situationship” of business law. Knowing the difference between JVs, partnerships, and LLCs can save you from legal and financial heartbreak.

What’s new: More Florida entrepreneurs are using JVs for real estate projects, start-up collaborations, and short-term investment deals. But confusion still reigns: is a JV just a partnership, or should you form an LLC? The answer depends on your goals and risk tolerance.

Key takeaways:

Partnerships = casual dating. No paperwork, no liability shield, and lots of personal risk.

LLCs = marriage. A formal, durable structure that protects assets and creates rules for management.

JVs = situationships. Temporary, project-based relationships that can be either contract-only or wrapped in an LLC.

Florida law doesn’t have a special “Joint Venture Act.” Instead, JVs are governed by contract terms or, if structured as an entity, by the rules of LLCs or corporations. This flexibility makes them powerful — but risky if you don’t draft the agreement carefully.

They’re also helpful when coupled with land trusts where multiple beneficiaries inside the trust can have a separate joint venture agreement that outlines who is bringing the money, and who is bringing the sweat to the deal, and what happens if things go great or sideways.

Bottom line: JVs let you collaborate without long-term strings attached, but they’re only as strong as the agreement behind them. Think of them as “define the relationship” talks in writing: who’s contributing what, how profits are split, and when the fling ends. A Florida business attorney can help you make sure the situationship doesn’t turn into a messy breakup.

4. Build a Personal Brand Without Trapping Your Business Inside It

Last Asheville sunset before moving home base back to Orlando for the year.

In real estate, your name can be the spark that opens doors and wins deals. But if your business depends entirely on you, its value plummets the moment you want to sell or step back. The goal: make your personal brand the growth engine, not the cage.

The challenge: Buyers don’t just look at your numbers—they look at your systems. If clients only trust you, then the business walks out the door when you do. That tension keeps many real estate entrepreneurs from going “all in” on personal branding, even though it’s a proven accelerator.

The playbook:

Front door, not foundation. Use your personal story, face, and voice to draw people in. But build the foundation—operations, tech, and people—that runs whether you’re in the room or not.

Institutionalize your personality. Whatever makes you magnetic—speed, luxury focus, transparency—turn it into documented processes and cultural norms. Buyers want a method, not a mystery.

Dual branding. Think “Powered by.” Keep your personal brand visible (podcast, YouTube, newsletter) while the company brand (brokerage, fund, or property management) handles the transactions. Leads flow in through you, but business runs on its own name.

Shift client trust to the team. Start highlighting “we” instead of “I.” Celebrate team wins publicly. Over time, clients will see your organization—not just you—as the trusted entity.

Build transferable digital assets. Email lists, CRM data, a content library, and business-owned social channels are assets a buyer can measure, value, and acquire. Personal Instagram followers? Not so much.

The bottom line: Your personal brand is a magnet—but magnets alone don’t build structures. Use it to accelerate growth, but package the systems, assets, and culture so the business stands alone.

The test: If you disappeared for six months, would revenue keep flowing? If the answer is yes, then your personal brand is doing its job—without stealing your exit strategy.

🚨 Automate Podcast Guest Spots and Fill Your Calendar Fast

If you’re a coach or consultant, podcast guesting is the NEW proven & fastest path to full calendars. Stop burning budget on ads and hoping for clicks. Podcast listeners lean in, hang on every word, and buy from guests who deliver real value (like you!). But appearing on dozens of incredible podcasts overnight as a guest has been impossible to all but the most famous until now.

Podcast guesting gets you permanent inbound guests, permanent SEO, and connects you to the best minds in your industry as peers.

PodPitch.com is the NEW software that books you as a guest (over and over!) on the exact kind of podcasts you want to appear on – automatically.

⚡ Drop your LinkedIn URL into PodPitch.

🤖 Scan 4 Million Podcasts: PodPitch.com's engine crawls every active show to surface your perfect podcast matches in seconds.

🔄 Listens to them For You: PodPitch literally listens to podcasts for you to think about how to best get the host's attention for your targets.

📈 Writes Emails, Sends, And Follows Up Until Booked: PodPitch.com writes hyper-personalized pitches, sends them from your email address, and will keep following up until you're booked.

👉 Want to go on 7+ podcasts every month and change your inbound for life? Book a demo now and we'll show you what podcasts YOU can guest on ASAP:

We hope you found this helpful — any feedback is appreciated and can be shared by hitting reply or using the feedback feature below.

Was this email forwarded to you? Subscribe here.

Have an idea or issue to share? Email us.

Connect with us using your preferred social media and website links for MyLandTrustee and Aspire Legal Solutions.

Our mailing address: PO Box 547945, Orlando, FL 32854-7945

Our physical address: 1901 West Colonial Drive, First Floor, Orlando, FL 32804

Be on the lookout for our next issue! 👋